Blog

You have real estate questions. We have real estate answers.

(We’re a match made in heaven, friends.)

CATEGORY

TAGS

- Active

- Advisor for Life

- Alamo Placita

- Allendale

- Anthology West

- Applewood

- Arbor Day

- Arvada

- Athmar Park

- Aurora

- Baker

- Barnum

- Beer

- Belmar

- Berkeley

- Boulder

- Breakfast

- Brighton

- Budgeting

- Buyer

- Buyer's Agent

- Buying

- CMA

- Cake Crumbs Bakery

- Capitol Hill

- Central Park

- Cheesman Park

- Cherry Hills Village

- Chessman Park

- Christmas Tree Recycling

- City Park South

- City Park West

- Coffee

- Coffee Shops

- Coming Soon

- Commerce City

- Compass Bridge Loan

- Compass Collections

- Compass Concierge

- Composting

- Condo

- Congress Park

- Connection

- Cory-Merrill

- Cottonwood

- Curb Appeal

- Curtis Park

- Decluttering

- Denver

- Denver Housing Market

From Pre-Approval to Closing Day: A First-Time Buyer’s Timeline

Buying your first home? From getting pre-approved to finally holding the keys to your dream home, there are a few important steps along the way. We’ll break it all down step by step so you know exactly what to expect.

Why Buy a Home, Anyway?

Most people make the transition from renting to buying a home because that’s just the natural progression of adulting, right? It’s what you’re “supposed to” do.

Call us contrarians, but we don’t think “buying a house is what adults do” is a sound enough reason to spend hundreds of thousands of dollars.

Instead, consider these actual reasons to opt for homeownership.

The True Costs of Moving.

When you’re looking to invest in a place of your own, it’s tempting to focus only on the big number: the price of the home itself.

That’s an important number, obviously. But to avoid some unpleasant surprises, it’s good to include the smaller expenses in your budget, too. Take, for instance, the move itself.

So let’s get real about expenses that make up the true cost of moving.

How to Make an Offer Sellers Can’t Refuse

To say the Denver market is “competitive” is an absurd understatement. Inventory is low, prices are high, and sellers are laughing all the way to the bank.

All is not lost. Even in this market, you can absolutely get a home you love at a price you won’t regret. All it takes is a skillfully crafted offer.

Here are 11 tools we use to make the magic happen.

How to Avoid Hiring a Lousy Buyer’s Agent

Quick real estate lesson: Agents make money through commissions. We get a percentage of the transaction every time we help someone buy or sell a home.

Know who pays the commission? The seller.

Since buyers don’t pay commissions, they often think it doesn’t matter what agent they choose to work with. But it does matter. A whole lot, actually.

This Blog Post is Not About Climate Change

Mostly, though, it’s about sustainable homeownership—ways to meet our needs today without negatively affecting future generations’ ability to meet theirs.

We’ve discovered loooootttts of first-time home buyers are concerned about taking up more space on the planet. So we thought we’d offer some of our favorite tips on being a more eco-friendly human.

How Homeownership Benefits Your Community

Owning your own home has a ton of personal perks: Privacy, agency, stability… and a sure path to long-term wealth. Yes, please!

But here’s the thing: The benefits of buying a home aren’t limited to you and your bank account. Given our country’s history of housing discrimination, homeownership is also a form of activism.

Three Things NOT to Worry About With Your First Home

When people start looking for their first home, they’re wide-eyed, broad-smiled, and giddily optimistic about finding exactly what they’ve always wanted.

Because we love you, we just want to warn you against that “exactly” idea.

Don’t mishear us: You’re making a big investment, so you get to be choosy and you should never, ever settle. We just want you to be particular about the right things.

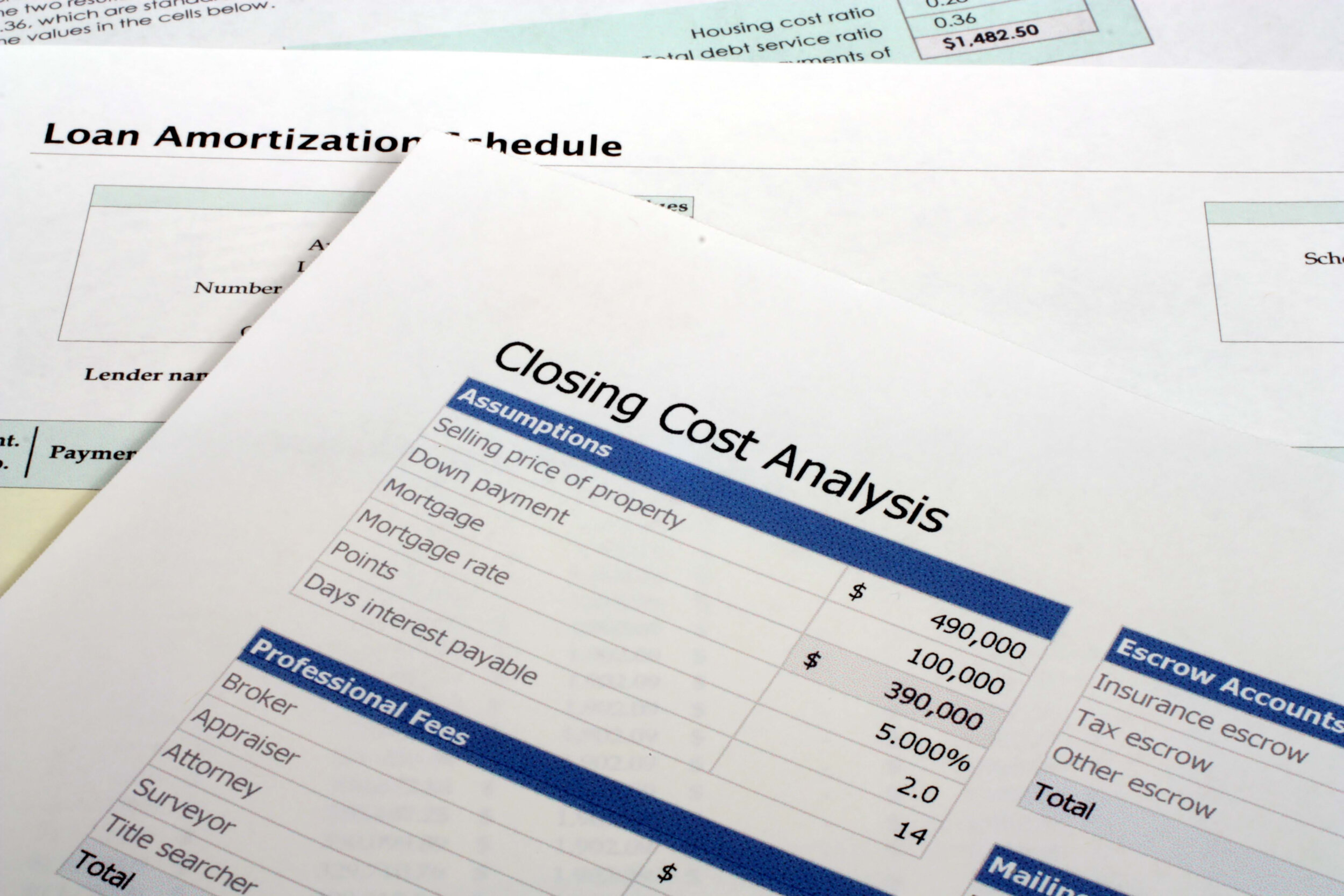

Everything You Need to Know About Closing Costs.

Closing costs include several fees that finalize your real estate transaction. Your lender can give you an estimate of your specific closing costs early on in the process, and you’ll get final numbers a couple of days before you close.

5 Ways to Improve Your Credit Score.

First-time home buyers are pretty great at coming up with reasons why they’ll never, ever be able to afford to take the leap. And somewhere near the top of that list is usually this one: “My credit score’s too low.”

Wanna know a secret? That’s rarely actually true. A lower-than-perfect score does not lock you out of the real estate game.

7 Steps to Save for a Downpayment.

As a first-time home buyer, coming up with tens of thousands of dollars for a down payment feels unattainable—at least in this lifetime.

Because saving is hard.

Know what else saving is? 100000% worth it.

How to Choose a Mortgage Lender.

Unless you have a pile of cash, the money part of buying your first home is arguably the most stressful, most nauseating, most OMG WHAT HAVE WE DONE part of the whole deal. And it doesn’t help that the process is shrouded in mystery.

Who DOES That?

It was 2018, and Brian and Krysten decided they were ready to make a move—in more ways than one.

They were in Connecticut, renting a small, “if you could call it a three bedroom” place from a friend. But they wanted a place of their own.

In Colorado.

The Three-Legged Stool

For most first-time home buyers, the list of must-haves is loooooooooooong, which pretty quickly leads to overwhelm, frustration, and disappointment. Instead of getting overly granular from the get-go, it’s way more helpful to think about this home-buying thing as a stool with three legs:

Real Estate in Plain English.

Part of what makes the home buying experience so stressful is all the wonky vocabulary.

Like, what the fork is earnest money? How are you supposed to feel confident financing your dream home when you don’t know the difference between pre-qualified and pre-approved? And what about the “oh $#!+” moment when you start looking over contracts and discover you have no clue what you’re actually agreeing to?

Buying your first home? Here’s what to do and when.

Buying your first home can be stressful for all kinds of reasons.

In this first-time home buyer series, we address all of these concerns (and many more). Today, we’re tackling that last one: What to do and when.

Three Things Zillow Won’t Tell You

When you decide you’re ready to start looking for your first place, the process becomes all-consuming.

Before you know it, you’ve downloaded multiple apps like Zillow and Trulia, spent hours scrolling through listings, and signed up for waaaaay too many email notifications.

Here’s the truth about those apps: They’re fun, but they’re not actually useful.